False Positives in AML: The Strain on Team Productivity

Financial institutions face an overwhelming number of alerts from anti-money laundering (AML) systems each day.

Recent industry studies estimate that 90% to 95% of alerts generated by traditional AML systems are classified as false positives.

Teams spend countless hours investigating these unnecessary alerts. This heavy workload drives up labor costs and causes significant stress. Employees often experience low morale and high turnover. The Human Cost of False Positives becomes clear as staff struggle to maintain focus and motivation.

False Positives Defined

AML Alert Basics

Anti-money laundering systems generate alerts when they detect transactions that appear suspicious. These alerts prompt compliance teams to investigate further. In practice, a false positive occurs when a normal transaction is incorrectly flagged as suspicious. The system wrongly categorizes a legitimate activity as risky, which leads to unnecessary scrutiny. Financial institutions rely on these alerts to prevent illegal activities, but the high rate of false positives creates significant challenges.

Compliance professionals must review each alert to determine its validity. They often find that most flagged transactions do not involve illicit behavior. This process consumes valuable time and resources. Teams must sift through large volumes of data, searching for genuine threats among many harmless transactions. The repetitive nature of this work can reduce efficiency and lower job satisfaction.

AML alerts serve as an initial filter, but their accuracy depends on the quality of data and system configuration.

Why They Happen

False positives arise from several factors within AML systems. Data quality plays a crucial role. Incomplete or outdated information can trigger alerts for transactions that are actually lawful. Lack of context also contributes to misclassification. When systems do not consider the full background of a transaction, they may overlook valid reasons for certain actions.

System configuration affects alert sensitivity. Overly strict settings can cause the system to flag normal behavior as suspicious. Errors in setup may result in missed threats or excessive false positives. The following table outlines the most common criteria used to classify an AML alert as a false positive:

|

Criteria |

Description |

|

Incomplete or

Outdated Data |

Alerts may occur due

to data that is not current or complete, leading to misinterpretation of

lawful transactions. |

|

Lack of Context |

Insufficient

context for transactions can result in false positives, as valid reasons for

actions may be overlooked. |

|

Configuration of

the System |

Errors in system setup

can lead to overly sensitive alerts or missed suspicious activities. |

Financial institutions must address these issues to improve the accuracy of AML alerts. By refining data management and system settings, teams can reduce the number of false positives and focus on genuine risks.

Operational Impact

Manual Review Burden

Compliance teams face a significant manual review burden due to high false positive rates in AML systems. Traditional systems generate a large volume of alerts, most of which do not indicate real threats. Teams spend about 32% of their workday investigating transactions that turn out to be legitimate. This wasted effort diverts attention from high-risk cases and increases compliance costs. The following table highlights key operational inefficiencies:

|

Evidence |

Description |

|

Wasted Resources |

Teams spend excessive

time on non-suspicious investigations. |

|

Increased Compliance Costs |

32% of the

day is spent on unnecessary investigations, reducing productivity. |

|

Damage to Customer

Relationships |

Legitimate

transactions face scrutiny, leading to customer frustration. |

Manual review processes also slow down transaction processing. Delays in name screening can hinder the timely identification of red flags, putting institutions at risk of regulatory penalties.

Alert Fatigue

High false positive rates overwhelm compliance analysts. Many report feeling exhausted by the constant stream of alerts. In fact, 83% of analysts feel overwhelmed, and 65% consider leaving their positions due to stress. This alert fatigue leads to desensitization, where analysts may overlook genuine threats. The operational strain grows as teams reactively clear alerts instead of proactively improving their systems.

The flood of 'noise' forces compliance analysts to spend countless hours on low-value tasks, driving up operational costs.

Investigation Quality

The quality of AML investigations suffers when teams must sift through thousands of false positives. Over 95% of alerts are false, consuming about 42% of compliance resources. This overwhelming workload diminishes the effectiveness of investigations. Important alerts may be missed, increasing the risk of financial crime. The Human Cost of False Positives becomes evident as staff struggle to maintain thoroughness and accuracy under pressure.

Human Cost of False Positives

Team Morale

The Human Cost of False Positives extends far beyond operational inefficiency. Compliance teams face a daily grind of reviewing thousands of alerts, most of which do not indicate real risk. This repetitive work erodes motivation and creates a sense of futility among analysts. The constant pressure to process high volumes of low-value alerts leads to widespread frustration.

A significant percentage—up to 95%—of alerts generated by AML compliance systems are false positives.

Managing these alerts requires thousands of personnel and costs hundreds of millions of dollars each year.

Reducing false positives can lead to substantial cost savings and improved team morale by alleviating alert fatigue.

Analysts often lose confidence in the monitoring system as false positives accumulate. Many report feeling that their efforts do not contribute to meaningful outcomes. This loss of purpose can quickly undermine team cohesion and engagement.

Teams that experience fewer false positives report higher morale and a greater sense of accomplishment.

Turnover and Burnout

The monotony of reviewing false positives takes a heavy toll on staff retention and well-being. Analysts spend hours on repetitive tasks, which increases the risk of errors and disengagement. The Human Cost of False Positives becomes clear when examining the psychological and organizational impacts.

|

Evidence Type |

Description |

|

Repetitive Work |

Analysts face a high

volume of low-risk alerts, leading to repetitive tasks that dampen

motivation. |

|

Error Rates |

Mental focus

studies indicate that monotony increases error rates by 15% after two hours. |

|

Disengagement |

46% of surveyed

analysts cite repetitive work as their top dissatisfaction factor. |

Staff who regularly handle large volumes of false positive alerts report significant stress. Many experience alert fatigue, which can lead to burnout and decreased job satisfaction. The inefficiency of investigating numerous low-risk alerts contributes to a loss of confidence in the system. High turnover rates become a persistent challenge as employees seek more fulfilling roles elsewhere.

AML staff face significant stress due to the inefficiency of investigating numerous low-risk alerts.

There is a noted loss of confidence in the monitoring system as false positives accumulate.

Alert fatigue is prevalent, which can lead to burnout and decreased job satisfaction.

The Human Cost of False Positives affects not only individual analysts but also the overall stability of compliance teams. Organizations must address these issues to retain skilled professionals and maintain effective anti-money laundering operations.

Financial and Business Effects

Increased Costs

Financial institutions face enormous expenses due to false positives in AML systems. The manual review of millions of alerts each year drives up operational costs. Compliance departments must allocate significant resources to investigate these alerts, often at the expense of other critical tasks. The following table highlights the financial burden:

|

Cost Type |

Estimated Amount |

|

Global AML

compliance costs |

Over $274 billion

annually |

|

Time to file a Suspicious Activity Report (SAR) |

Up to 22

hours per alert |

|

Percentage of false

positives |

95% of alerts

generated |

The volume of false positives, which can reach up to 124 million per firm annually, overwhelms analysts. Teams must dedicate extensive time and effort to manual investigations. This inefficiency results in billions of dollars wasted across the banking industry. The pressure to clear alerts quickly often leads to shortcuts, increasing the risk of missing genuine suspicious activities.

False positives generate excessive alerts, overwhelming analysts.

Delays in investigations increase resource allocation.

Shortcuts taken under pressure can risk missing real threats.

Lost Opportunities

Excessive false positive alerts block legitimate transactions and disrupt business operations. Financial institutions lose revenue when valid customer activities are delayed or denied. The strain on resources prevents teams from focusing on strategic initiatives. The table below outlines common business impacts:

|

Impact Type |

Description |

|

Blocked Legitimate

Transactions |

Each false positive

results in a legitimate transaction being blocked, leading to lost revenue. |

|

Reputational Damage |

Customers may

have a negative impression of the service, potentially leading them to

competitors. |

|

Wasted Resources |

Investigating false

positives strains resources that could be used more effectively elsewhere. |

Lost opportunities extend beyond immediate financial losses. Customers who experience repeated disruptions may choose competitors, reducing market share and long-term profitability.

Reputational Risk

False positives in AML systems threaten the reputation of financial institutions. Outdated rule-based systems generate thousands of irrelevant alerts, frustrating clients and regulators. High compliance costs signal inefficiency, while frequent disruptions erode trust. The table below summarizes reputational risks:

|

Evidence Type |

Description |

|

High Cost of

Compliance |

Traditional rule-based

systems generate high false positives, driving operational costs up. |

|

Reputational Damage |

Robust

AML/CFT systems protect institutions from reputational damage, regulatory

penalties, and customer loss. |

|

High False

Positives |

Outdated rule-based

systems generate thousands of irrelevant alerts. |

Financial institutions must address these risks to maintain credibility and avoid regulatory penalties. A strong AML system not only protects against financial crime but also preserves customer trust and market reputation.

Reducing False Positives

System Improvements

Financial institutions can lower false positive rates by refining their AML systems. Teams should adopt a risk-based approach, focusing on higher-risk customers and products. Integrating AML and counter-financing of terrorism (CFT) functions helps avoid silos and improves detection quality. Clean, standardized data enhances model performance and reduces screening inaccuracies. Regular independent reviews validate system performance and ensure compliance alignment. These improvements allow compliance teams to allocate resources more effectively and reduce the Human Cost of False Positives.

Continuous learning and regular updates to detection typologies help institutions stay ahead of evolving financial crime tactics.

Training and Support

Ongoing training equips analysts with the skills to recognize genuine threats and avoid unnecessary investigations. Institutions should invest in programs that teach staff how to interpret alerts and use advanced tools. Supportive work environments encourage collaboration and knowledge sharing. When teams understand the system’s logic and limitations, they can make better decisions and reduce error rates. Training also helps analysts adapt to new technologies and regulatory changes.

Technology and Automation

Modern technology plays a crucial role in minimizing false positives. AI and machine learning systems analyze transaction patterns and adapt in real time, enhancing detection accuracy. Automation of routine compliance tasks streamlines processes and reduces the burden on human teams. Scenario-based monitoring customizes detection to specific risk profiles, improving the identification of genuine threats. High-quality structured data further decreases false alerts.

|

Technology/Automation |

Effectiveness in

Reducing False Positives |

|

AI and Machine

Learning |

Analyzes patterns,

adapts in real time, and improves detection accuracy. |

|

Automation of Routine Compliance Tasks |

Streamlines

processes and minimizes human errors. |

|

Scenario-Based

Monitoring |

Customizes detection

to match risk profiles and identifies genuine threats. |

|

Enhancing Data Quality |

Improves risk

assessments and reduces false alerts through better data management. |

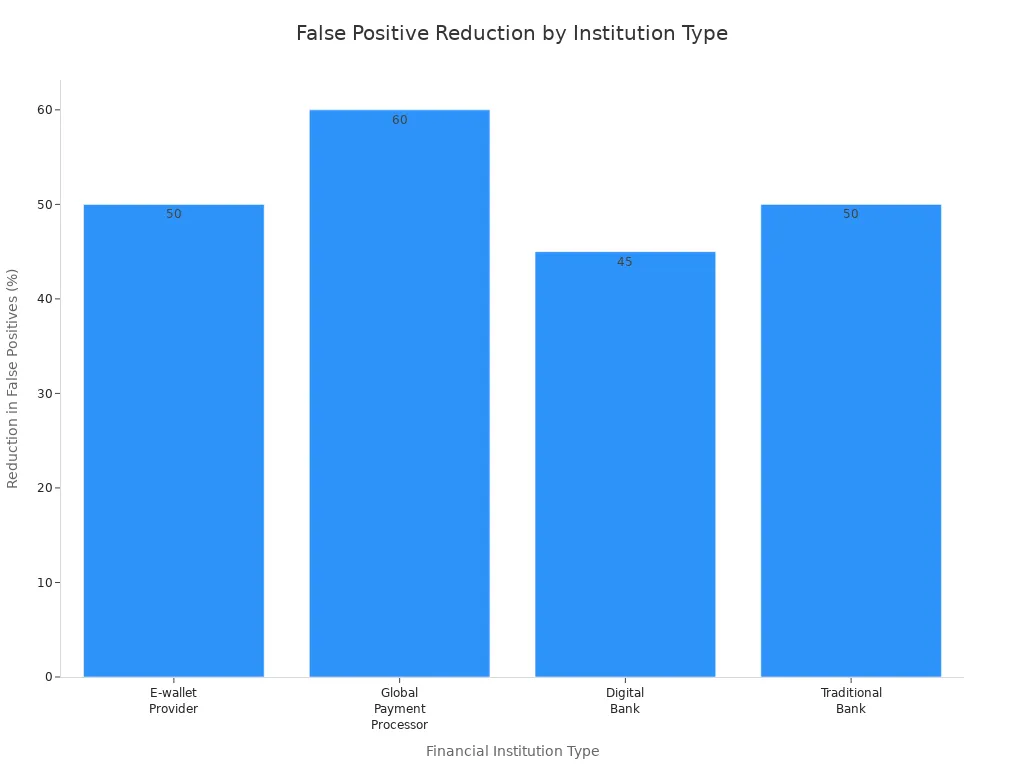

Institutions that leverage these solutions see fewer false positives, lower operational costs, and improved team morale.

False positives in AML systems undermine team productivity and morale, forcing compliance analysts to spend hundreds of hours on unnecessary investigations. Organizations that adopt AI-powered monitoring and automation report shorter investigation cycles and improved detection rates.

|

Strategy |

Description |

|

Customizing Rules |

Tailors monitoring to

customer profiles and risk ratings. |

|

Unified Platforms |

Enables

holistic risk assessments and better data sharing. |

Leaders should prioritize advanced technologies and ongoing training to reduce false positives, enhance operational efficiency, and protect reputation. Future trends point to behavioral analytics and contextual scoring as key drivers for sustainable improvement.

Key Takeaways

Financial institutions face a staggering 90% to 95% false positive rate in AML alerts, leading to wasted time and resources.

Reducing false positives can significantly lower compliance costs and improve team morale by alleviating stress and alert fatigue.

Investing in advanced technologies like AI and machine learning enhances detection accuracy and minimizes unnecessary investigations.

Ongoing training for compliance teams is essential to help analysts recognize genuine threats and improve overall investigation quality.

Streamlining AML processes through better data management and system configuration can lead to more effective risk assessments and fewer false alerts.

Comments

Post a Comment